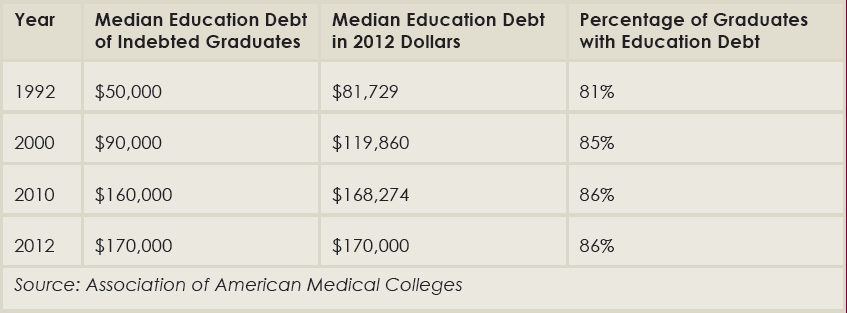

When it comes to debt management, physicians have specific needs. Their most common and pressing need is determining how to deal with student loans after completing medical school. On top of a mortgage-sized student loan debt, physicians may have accumulated credit card debt and other consumer debt after purchasing a home or car.

When it comes to debt management, physicians have specific needs. Their most common and pressing need is determining how to deal with student loans after completing medical school. On top of a mortgage-sized student loan debt, physicians may have accumulated credit card debt and other consumer debt after purchasing a home or car.

Explore This Issue

December 2014The amount of debt can be demoralizing. “Many of my physician clients have between $200,000 and $300,000 of student loan debt,” said Joshua Thompson, CFP, EA, president and founder of Consilium Management Group, LLC, in Tampa, Fla. “This can make life stressful when coupled with the fact that many residents only make $45,000 to $55,000 per year for the first three to five years.”

Having an action plan can help reduce the debt as well as the emotional burden. Options are available to help young physicians take control of their student loan debt. “The earlier a physician takes ownership of his or her debt, the more control they will have of their financial future,” Thompson said.

Here’s a look at some options you may want to consider.

Income-Based Repayment Plans

These plans are intended for physicians who have a lower annual discretionary income than their debt load. They are designed to make student loan debt more manageable by reducing the monthly payment amount. The plans come in three forms:

- Income-based repayment plan (IBR plan);

- Pay as you earn (PAYE) repayment plan; and

- Income-contingent repayment plan (ICR).

All of these plans extend the loan period, lowering the monthly payment.

Required monthly payment amounts are determined as a percentage of one’s discretionary income; percentages are between 10% and 20%, depending on the plan and when the loan was created. “Some recipients have no monthly payment if they have the right income and family size,” said Randy M. Long, JD, CFP, CExP, president of Long Investment Advisory, Inc., in Wilmington, N.C. To qualify for an IBR or PAYE, a physician must have federal student loan debt that is higher than his or her annual discretionary income or that represents a significant portion of annual income. To apply for a PAYE loan, you must be a new borrower as of October 1, 2007, and must have received a disbursement of a federal direct loan on or after October 1, 2011.

Income-driven plans benefit physicians who are unable or unwilling to make the monthly payment of the government’s 10-year Standard Repayment Plan. “The plan is attractive because the loan is usually forgiven after the end of the term (often 25 years),” Long said. “The downside is that these types of loans take an incredibly long time to pay off and only serve the physician who has debt loads representing a significant portion of his annual income.” In reality, income-driven plans are only worthwhile if the physician can qualify for a lower monthly payment than those available from the 10-year Standard Repayment Plan.

The earlier a physician takes ownership of his or her debt, the more control they will have of their financial future.—Joshua Thompson, CFP, EA

The earlier a physician takes ownership of his or her debt, the more control they will have of their financial future.—Joshua Thompson, CFP, EAPublic Service Loan Forgiveness

The Public Service Loan Forgiveness (PSLF) Program encourages physicians to choose a career in the public service sector of medicine, promising to pay off a physician’s remaining federal student loan balance if he or she works full time for a qualified employer and makes 120 qualifying student loan payments. A significant advantage is that this forgiveness is not taxable, unlike other forgiveness options.

Be cautious, however. “The federal government could discontinue this program at any time with little or no notice,” said Paul Larson, CFP, CLU, founder, president, and CEO of Larson Financial Group in St. Louis, Mo. “But this is unlikely to happen anytime soon.”

Some qualifying employers include federal, state, and local government agencies or organizations, AmeriCorps or Peace Corps, nonprofit organizations that have been designated as tax exempt by the Internal Revenue Service, and private nonprofits that provide specified public services, such as military, law enforcement, public health, and public education.

If you want to take advantage of multiple options, Thompson advised that you start to repay student loans under IBR/PAYE right out of medical school, especially if you plan to do a fellowship and then work in a public service setting. “Potentially having $50,000 to $200,000 in loans forgiven (tax free) over a 10-year period is a great investment,” he said.

Loan Consolidation vs. Loan Refinancing

Loan consolidation and loan refinancing are often used in tandem. Consolidation is the process of bundling multiple loans and payments from different vendors into a single loan and payment to one servicer. The borrower benefits from having less hassle, a lower risk of missing a payment due to neglect, and less complexity. Having a single loan makes debt more manageable and progress more measurable. “The downside is that the borrower will lose out on any special benefits on the individual loans such as interest rate discounts, principle rebates, or forgiveness periods,” Long said. Also, the new interest rate is a weighted average of the consolidated loans, so the rate will be rounded up by the nearest one-eighth of a percent.

Loan refinancing involves the restructuring of the loan’s term, monthly payment amount, or interest rate. “A refinance happens when a third-party lender is willing to give you the money to pay off your current loan but will charge you a lower interest rate (or extend the term or drop the payment),” Long said. In order to qualify for a refinance on your student loans, most banks require at least a 640 credit score, a maximum monthly debt-to-income ratio of 45%, and a minimum monthly gross income of $2,000. Most borrowers refinance their loans when they are consolidated.

Student Loan Repayment vs. Investing

If you do not have an emergency fund, Larson said your dollars are probably best allocated to building one rather than paying down loans that are in deferment or forbearance. However, there are some benefits if you elect to repay your student loans instead. “Reducing your principal balance can minimize any capitalized interest and allows you to have some peace of mind, knowing your debt is getting reduced,” he added.

Long believes it is wiser to allocate resources to student loan repayment than to investing. “The stock market is volatile and mostly favorable to long-term and patient capital,” he said. “On the other hand, loan repayment contributes positively to net worth immediately, has favorable tax deductions attached, and lowers the overall risk that debt entails.”

Many physicians believe that they can make higher percentage gains in the stock market than they pay in debt interest. “While this may be true at certain times, it introduces a new level of risk into the doctor’s finances,” Long said. Financially, student debt loads hurt one’s credit, which adds expense to purchases such as house mortgages and insurance. Pouring cash flow into stocks instead of paying off debt is essentially doubling down one’s risk, the same basic concept as borrowing $100,000 to invest with, because you are merely investing with leverage. “It has the potential to work out, but it also may result in losing not only investment monies, but personal assets as well. There are also taxes to pay should you make gains, plus the costs or fees incurred from investing,” he added.

The bottom line is that debt loads can limit your options, such as taking a new job or saving up for retirement. “In today’s economic environment,” Long added, “it is increasingly imperative for physicians to unburden themselves from debt loads to protect their families and provide greater freedom of choice.”

Karen Appold is a freelance medical writer based in Pennsylvania.