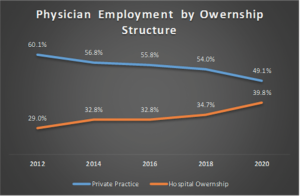

Medical payment disparities have persisted for decades despite site-neutral payment legislation and Medicare rules. They have allowed hospital systems to capitalize on arbitrage opportunities, motivating a consolidation of independent practices into their networks. We see this play out in the data. The American Medical Association produces physician benchmarking surveys every two years. The most recent iteration showed private practice employment had reached an alltime low, losses that were mirrored by gains in hospital employment (Kane CJ. Policy Research Perspectives. AMA. 2021) (Figure 1).

Explore This Issue

July 2022This shift toward an employed model has been more marked among primary care, with the same survey showing 58% of family practice and pediatrics in employed status in 2020. Practice acquisition has accelerated during the pandemic, with recent research showing a 38% increase in corporate owned practices between January 2019 and January 2022 (PAI-Avalere Health Report on Trends in Physician Employment and Acquisitions of Medical Practices: 2019-2021. April 2022).

These competitive dynamics and the resultant increase in healthcare costs are so remarkable that they are now being investigated by the Federal Trade Commission. And while surgical specialties have a higher level of private ownership, primary care represents the referral sources for subspecialty care. These referrals allow for pre-existing specialty practice growth and new service lines where they didn’t exist before. In other words, where primary care has already gone may be where subspecialty care goes in the future.

To the degree the willingness to supply labor has any real impact on choice of employment under various ownership structures, where will new graduates, who have hundreds of thousands of dollars of school debt, be more inclined to work? They’ll increasingly migrate to 501(c)(3) hospital entities where Public Service Loan Forgiveness (PSLF) will write off remaining debt balances.

Competition and Value

These market forces, however inefficient from a consumer value perspective, absolutely affect job availability and our workforce complexion. Luckily, the market has a knack for pushing back against inefficiencies. On the consumer side, price transparency tools and atypical means of establishing referrals without primary care involvement seek to disrupt the current construct. On the structural supply side, theoretical disruptive forces exist as well. In the past, when you had more generalists and a stronger private practice market, most would enter private practice or non-academic hospitals. When patients required subspecialty care referrals, they were sent where subspecialists were concentrated: academic centers.